Five ways to save the Capacity Investment Scheme from attack by zombies

APRIL 2024

For the Federal Government’s Capacity Investment Scheme to deliver on its objective of inducing 23 gigawatts (GW) of new variable renewable energy capacity, will require a dramatic increase in the speed and scale we roll out renewable energy. The government is aiming to have the entire 23 gigawatts (GW) of projects selected and contracted within four years such that they can then all be built and in operation by 2030. That equates to almost 6GW being contracted each year.

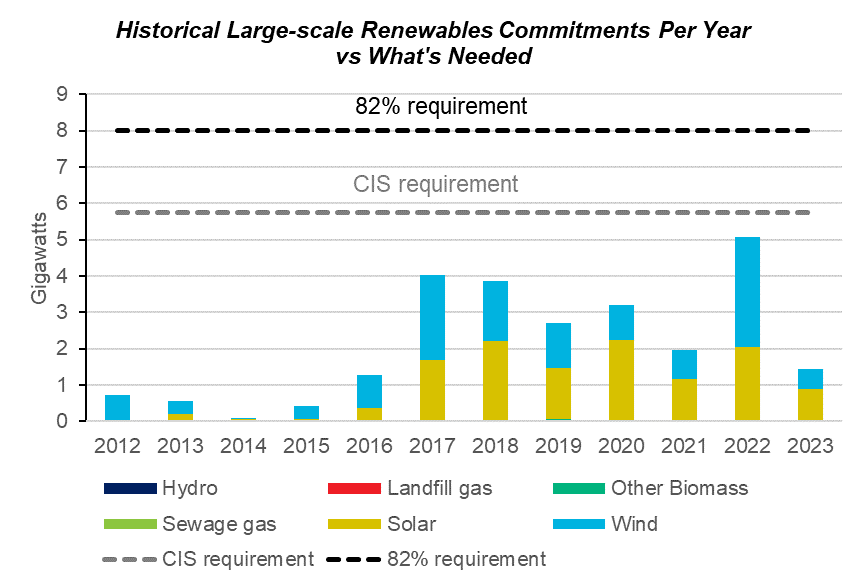

On top of this state governments, in particular NSW, will need to continue their own processes to underwrite new capacity. This is because 23GW is not enough to achieve 82% renewable energy target if electricity demand growth follows the inflection upwards AEMO projects in its Step Change scenario. This increase in demand is due to an assumed electrification of transport and gas appliances. Instead, analysis within our quarterly Renewable Energy Market and Investment Review suggests 32GW of new large-scale renewable energy projects are needed for the NEM and SWIS grids (also of note is that rooftop solar will need to grow at the rapid level estimated under the Step Change Scenario). Assuming an average 2 year construction time per project (which was typical prior to changes in system strength rules) means we need to be committing 8 GW of new projects per annum from 2024 until 2027 such that we’d have the full 32GW in place at the beginning of the year in 2030.

Yet irrespective of whether it is 6 or 8 gigawatts, as the chart below of Australia’s annual renewable energy project commitments illustrates, it’s a big step up relative to the level of construction commitments Australia has achieved historically.

Source: Green Energy Markets’ Renewable Energy Market and Investment Review database

We should not let history define what we are capable of in the future, but it shows that there is some significant work to do, and we cannot afford to waste much time.

While we are starting to get some reasonable practice at running government contracting processes for new renewables and energy storage projects, they can get bogged down in lengthy evaluations of:

· A proponent’s capability to deliver the project,

· the projects’ technical and commercial viability,

· the level of community support and acceptance for the project,

· possible environmental and heritage impacts;

· and the level of local supplier involvement and content.

These are not simple questions. Experienced major renewable energy investors have gotten these things wrong in the Australian market. Several have found themselves with seriously underperforming projects which suffer from severe transmission and economic curtailment. This is something we explore at length in the paper, Australia’s Renewable Energy Boom – The Good, The Bad and the Downright Ugly.

If you don’t do these evaluations well it can undermine the entire effectiveness of the contracting process. This is because it can allow unrealistically optimistic bidders to undercut the more capable proponents who have a better understanding of project economics and risks. At the end of the tender the government may end up with a great press release – lots of projects contracted at a low price. But then many of them never get built. That’s what was found for low emission technology tendering programs under the Howard and Rudd Governments, as detailed in the Grattan Institute report I co-authored with John Daley, Learning the Hard Way. What makes such an outcome particularly sinister is that even good projects can take a long time between receiving a contract and being committed to construction. So, it doesn’t become clear that a government program isn’t working until two or three years down the track when we can confidently declare a tender winner is really a zombie project, with no realistic prospects of advancing. We don’t have that amount of time to waste.

Yet undertaking a thorough evaluation and selection process also takes time. The Victorian Government announced it would undertake a tender to procure 600MW of renewable capacity back in June 2017 (known as VRET 1). The tender opened to bids in November that year but didn’t announce the winners until September the following year. Also, in spite of a lengthy evaluation process, one of the six winning projects, Carwarp, is still yet to be committed to construction because it is subject to serious grid constraints. Victoria’s second stage auction for 650MW commenced a “market sounding” in September 2020, but didn’t open the tender to bidders until August 2021. It then took over a year to complete the tender evaluation with winners announced in October 2022. Based on the information we currently have available just one of the six winning bids has commenced construction as at the end of March 2024.

Not all government renewable energy tender processes take this long. But the Victorian experience illustrates the challenges and risks that the Federal Government needs to manage if the Capacity Investment Scheme is to effectively roll-out renewable energy at the pace required. In fact, the challenges are even greater for the Federal Government than what the Victorian Government faced, because the scale of the CIS is so much bigger.

In an ideal world government would avoid using a tendering program to drive decarbonization of the electricity sector. Instead, they’d use a carbon pricing mechanism which rewarded and penalized power plants based on their actual emissions to the atmosphere, thereby avoiding the need to try to determine which projects are best well in advance of them being operational, and when most will be nothing but an empty paddock. But alas we can’t turn back time to sabotage Abbott’s successful challenge of Malcolm Turnbull’s leadership in 2009.

So in lieu of a time machine to take us back to when there was a bipartisan consensus on carbon pricing, we need to make sure the CIS is structured to minimize the risks of zombie projects and rewards bidders who have commercially viable projects that they can deliver on a rapid timeframe. It also needs safeguards that enable failures in the selection process to be revealed quickly, so that the causes of these failures can be addressed early rather than left to fester.

In the remainder of this paper we outline five options to counter the risks of zombie projects:

1. Create a race through oversubscribing tender rounds relative to a megawatt target and make contracts contingent on getting to construction commitment ahead of the target being reached. The aim is to keep the pressure on tender winners to reach construction commitment as fast as possible and weed out projects which are slow to progress.

2. Provide an exceptional value standing offer underwriting contract that projects can access outside of the tender process once they reach construction commitment. There will be cases of developers who might score poorly in a tender evaluation but who manage to surprise us with their ability to progress a project to construction commitment, if they were able to lock-in underwriting support.

3. Make it a condition of tender eligibility that projects must already have necessary government planning and environmental approvals. Planning approvals in some states can take years, so awarding contracts to projects without approvals increases the risk the CIS will end up with projects that don’t get built within the required short time frames.

4. Keep tenders to a national basis, don’t pre-allocate capacity to individual states. This will put the pressure on states to compete against one another with fast approvals and supporting infrastructure to create a pool of competitive projects.

5. Don’t try to get a tender process to do what is best dealt with through planning policy. Drop selection criteria relating to community engagement and social licence and leave this to the planning approval process.

These five options are explained in further detail in the headings below.

1. Create a race through oversubscribing tender rounds and making contracts contingent on those that get in first to achieve a capacity target

One of the problems with tenders is that once a project has won the tender they are no longer in a competitive situation, taking the pressure off them to deliver the project as quickly as possible. While contracts will often impose deadlines for projects to achieve milestones, governments can be tempted to let these slide to avoid publicly acknowledging what can be perceived as a failure of the program (or it might be the fact the government was genuinely to blame that the deadline was missed because they were too tardy in providing planning approval or facilitating construction of additional transmission capacity). In private sector contracting this kind of problem is often managed through requiring the project owner to make good on non-delivery of electricity or carbon offsets if their project runs late, or paying some other kind of financial penalties. But this can be considered excessively onerous in government tendering programs where the whole intent of the program is to facilitate development and progress of projects well before they are ready to commit to construction.

To counter these issues, in each tender round the CIS should award underwriting contracts to more project capacity than what they are explicitly targeting (provided those bids offer prices which fall below an undisclosed threshold which the government determines as representing good value for energy consumers). However, these contracts would be contingent on a project being committed to construction in advance of a capacity target being fulfilled. Underwriting contracts would then expire for those projects which were still yet to be committed to construction once the capacity target was met. They would then need to resubmit bids into a subsequent tender round if they still wished to obtain an underwriting contract.

2. Provide an exceptional value standing offer underwriting contract that projects could access outside of the tender process.

The reality is that sometimes people can surprise you and manage to achieve more than you expected. They may look inexperienced or lack the kind of credentials that you consider important to doing a good job, but in spite of their disadvantages they somehow find a way. Maybe it turns out they know something so-called experts don’t. Plenty of icons of the business world fit this description, becoming billionaires in spite of, and perhaps because of, their inexperience and lack of training and education.

Unfortunately, tender processes will explicitly eliminate the potential for pleasant surprises, by excluding any proponent that lacks the kind of characteristics traditionally thought important to be capable of delivering a successful project. If they didn’t, then there’s a very high risk we’ll end up with lots of zombie projects which might bid fantastically low prices but just drive out the more realistic project bids that would actually get built.

So we need to provide an alternative avenue to encourage and reward those who it turns out can get a project built, irrespective of their past experience or the size of their firm. Also the government is currently planning on explicitly excluding projects smaller than 30MW from participating in the CIS to reduce the administrative burden of tender evaluation. Yet such smaller projects could be a very good way to get around the transmission capacity constraints that are holding back the progress of large projects and which will take considerable time to resolve. The government can’t afford to handicap itself by removing the potential for these smaller projects to deliver capacity rapidly.

A way that the CIS could encourage the potential for pleasant surprises and smaller projects is though the provision of a standing offer underwriting contract, open to anyone who can manage to get their renewable energy project to the point of construction commitment. Once a project has reached construction commitment it shouldn’t matter what the proponent’s credentials or experience might be, in the end they’ve achieved precisely what the CIS is aiming for – megawatts in the ground. For those concerned that construction commitment isn’t the end point, please remember that if the project turns out to be a lemon and doesn’t generate as much electricity as hoped, then it doesn’t get as much benefit from the underwriting contract. The underwriting contract isn’t a lump sum grant paid on construction completion, instead it is paid per megawatt-hour of electricity produced.

The standing offer would need to set floor and cap prices (differentiated by state and technology generation profile) at low levels such that it didn’t undermine the incentive for well credentialled proponents to bid highly competitively in the tenders, or opt out altogether from the tenders. These prices, for example, could be tied to the lowest priced bids in the tender for each state and then held at that level for the next 18 months before being updated based on new bid information.

However, it is also worth considering the potential to offer underwriting prices at a higher level than the lowest priced bidder, but still a price considered to be extremely good value. This could be done while still maintaining an incentive for competitive tender bidding by restricting eligibility for standing offer contracts to projects below say 200MW in scale, or to companies with few existing projects. The government should also impose a cap on the amount of aggregate capacity that can claim the standing offer over each year to guard against the risk (if you could call it that) that renewable energy projects turn out to be cheaper to build than anticipated, such that the standing offer is too generous. At the same time the capacity cap will also act as a spur for project proponents to move quickly.

There will no doubt be some who will be nervous that the creation of a publicly declared standing offer will reveal important price information to bidders that might encourage them to up their bids in future tender rounds. The response to these concerns is,

‘Yes it might tip the scales slightly away from a massive, almost monopsony, buyer. But if value for money is all you care about then why tender for 23 GWs in such a short period of time and instead just tender for 1GW? You’ll get way better value for money that way, it’s just you’ll completely fail on your emission reduction goals.’

In the end this is a balancing act between speed and scale versus value for money. The government has set extremely ambitious targets. For them to be achieved the government needs ways to get around the weaknesses of a tender process to maximise participation, and reward those that can get projects to construction quickly. A standing offer contract will help achieve this.

3. Make it a condition of tender eligibility that projects must already have necessary government planning and environmental approvals

It is understandable that the government will want to maximise the pool of projects participating in its first few tenders. This will elevate levels of bidding competition and provide a good impression to stakeholders that the scheme is having a significant positive impact, and the government is making good progress on its commitments. However, sometimes it can be wise to hasten slowly, accepting that you might have to take things slower than ideal early on, in order to give you a better chance of achieving your ultimate goals over the longer run.

Unfortunately, the long-winded nature of the planning approval process in some states can take an exceedingly long period of time. According to an assessment by the law firm Herbert Smith Freehills the average timeframe that wind projects took to receive a planning approval in NSW was almost ten years. Other states are usually better than this, but they too can sometimes drag out to several years. This is especially true if you take into account the frequent need for approval modifications due to advancements in wind turbine technology that unfold while a project is going through the development process.

The Federal Government will be setting itself up for failure if it chooses to award underwriting contracts to a large proportion of capacity that is yet to receive planning approval. If the NSW timeframes persist, we could end up in a ridiculous situation where 2030 has come and gone and projects awarded underwriting projects in NSW in 2024 could still be waiting for planning approval, let alone be constructed and commissioned.

Green Energy Markets’ Project Development Database indicates that there are around 10,000MW of live wind and more than 20,000MW of solar projects nationally with planning approval which are not yet committed to construction or contracted (excluding the energy export oriented mega project of the Pilbara Energy Hub). While this sounds like a lot, solar projects are of limited market value until we can substantially grow daytime electricity demand through electrification and energy storage, so wind capacity is what really matters. The first tender of 6,000MW would gobble up much of that approved wind capacity, which may make the Federal Government reluctant to restrict eligibility only to projects with planning approval. But the alternative is setting up a potential fool’s paradise.

There’s no getting around the reality that states’ planning processes will have to accelerate to a tempo of capacity that aligns with, or exceeds the scale of capacity required by the CIS tenders. If planning departments are falling short, then it would be better to confront this well before 2030 to give us the time to either fix it, or re-evaluate our policy options and goals. The problem is that if the CIS fails then we will also fail to meet our Paris emission reduction commitments. We can’t afford to paper over a slow approval process and hope for the best.

A further side benefit of restricting eligibility to only projects with approvals in place is that it puts explicit pressure on the states with slow approval processes to fix them or miss out. The CIS will support billions in investment, thousands of jobs and substantial additional electricity supply that will be important to lower electricity prices – all underwritten by the Federal Treasury. If there’s one thing that motivates a state government, it is the prospect of missing out on Federal Government investment support to another state.

4. Keep tenders to a national basis, don’t pre-allocate capacity to individual states

This raises another issue which is why is the Federal Government planning to pre-allocate capacity to a particular state separate to the tender evaluation process via ‘Renewable Energy Transformation Agreements’?

The best way to put pressure on states to improve planning processes, upgrade transmission and other supporting infrastructure, as well as other project input factors is to pit them in competition with other states. Those states which have a large pool of projects with planning approval, provide access to transmission capacity and that help keep the cost of construction low should naturally end up with projects that rate well in the tender evaluation.

Also, the financial part of the evaluation (based on energy market modelling) should automatically prioritise projects which deliver electricity into the states which most need it and where it is of greatest value. For example, if NSW is expected to be short of energy in the next ten years due to anticipated coal power plant closures, then wind projects located in that state will probably present better financial value because they are less likely to need to draw upon underwriting agreements to top-up their revenues.

Lastly, keeping tenders at a national level maximises the level of competition between projects, and so should help ensure better value for money for taxpayers.

5. Drop criteria relating to community engagement and social licence and leave these issues to be dealt with through planning approval policies

Planning approval policies are intended to manage the reality that there are often trade-offs and conflicting interests in how land is used. There will be winners and losers out of any major land use change such that you can’t make everyone happy, and you can’t avoid some level of conflict and dissatisfaction. We’ve tried to avoid conflict in housing development in this country and it has landed us with an entire generation of people priced out of ever having a chance of owning a home. We can’t afford to make the same mistake with power supply and mitigating climate change.

The kind of skills involving in running an efficient and timely tender process to select the most economic and technically feasible renewable energy projects are very different to the skills involved in managing the trade-offs and conflict involved in land use change. If there’s certain things that we think developers of renewable energy projects should do to help manage and minimise the level of conflict and dissatisfaction associated with these projects, then let’s change the planning policy. Don’t try to make an underwriting contract tender process also double as planning policy.

If we muddle the two, we run the risk of creating a project selection process clouded by vague qualitative criteria that can make it very hard to determine who should win and why. This increases uncertainty and costs for investors which flows through in higher prices to consumers. At the same time it opens the door to political interference that can descend into things like Bridget Mackenzie’s colour-coded spreadsheet and Ros Kelly’s whiteboard as a model for project selection.

The aim of this exercise isn’t to select the most popular projects, it’s to select the projects that will allow us to lower electricity prices and reduce greenhouse gas emissions as quickly and cheaply as possible.

Tristan Edis is Director of Analysis and Advisory at Green Energy Markets. Green Energy Markets provides analysis and advice to assist clients make better informed investment, trading and policy decisions in energy and carbon abatement markets.